For many founders, pricing is the most uncomfortable decision in the entire business. Building feels productive. Research feels responsible. Improving the product feels safe. Charging for it feels exposed.

Pricing forces a founder to answer a difficult question early: Is what I built actually valuable enough that someone will pay for it?

This is why pricing often gets reduced to spreadsheets, formulas, or copying competitors. Not because those methods work, but because they create emotional distance from rejection. If the price comes from “the math,” then a no feels less personal.

The problem is that pricing does not fail because founders lack numbers. It fails because they start from the wrong place.

Pricing is not a calculation. It is a strategy. And strategies are discovered through value, context, and real signals, not guesses.

1. Why Cost-Based Pricing Fails Early-Stage Founders

The most common pricing mistake is simple: adding a margin on top of costs and calling it a price.

Costs are important. They tell you whether your business can survive. They do not tell you what your product is worth.

Customers do not buy your software subscription, your consulting hours, or your production expenses. They buy outcomes. Relief from a problem. Progress toward a goal. Reduction of risk. Saving time. Increasing income.

When pricing is anchored to costs, three things usually happen:

The product is underpriced relative to its impact.

The business struggles to grow sustainably.

The founder compensates by working more instead of charging better.

This contrast is where most founders experience their first real mindset shift.

| Aspect | Cost-Based Pricing | Value-Based Pricing |

|---|---|---|

| _____________________ | ____________________________ | __________________________________ |

| Anchor _____________________ | Internal expenses ____________________________ | Customer outcomes __________________________________ |

| Focus _____________________ | Survival ____________________________ | Impact __________________________________ |

| Risk _____________________ | Underpricing ____________________________ | Strategic confidence __________________________________ |

| Market signal _____________________ | Insecure positioning ____________________________ | Intentional positioning __________________________________ |

| Long-term effect | Burnout | Sustainability |

2. Value Is What Customers Actually Pay For

Price is anchored to perceived value, not effort or complexity.

A product that takes ten minutes to deliver can be priced higher than one that takes ten hours if the outcome matters more. A service that reduces risk or prevents loss often commands higher prices than one that simply improves convenience.

Value increases when:

The problem is painful.

The outcome is urgent.

The cost of inaction is high.

The buyer trusts the solution.

This is why two products with similar features can have wildly different prices. The difference is not the product. It is the problem being solved and the context in which it is solved.

Founders often confuse value with features. Customers experience value as relief.

Understanding this intellectually is important. Applying it requires context. That context comes from the market.

3. The Market Creates the Pricing Range

Your price does not exist in isolation. It lives inside a range created by alternatives.

Competitors do not define your price, but they define expectations. A buyer approaches your offer with an internal reference point shaped by what else they have seen, tried, or heard about.

This does not mean you copy competitors. It means you decide where you sit relative to them.

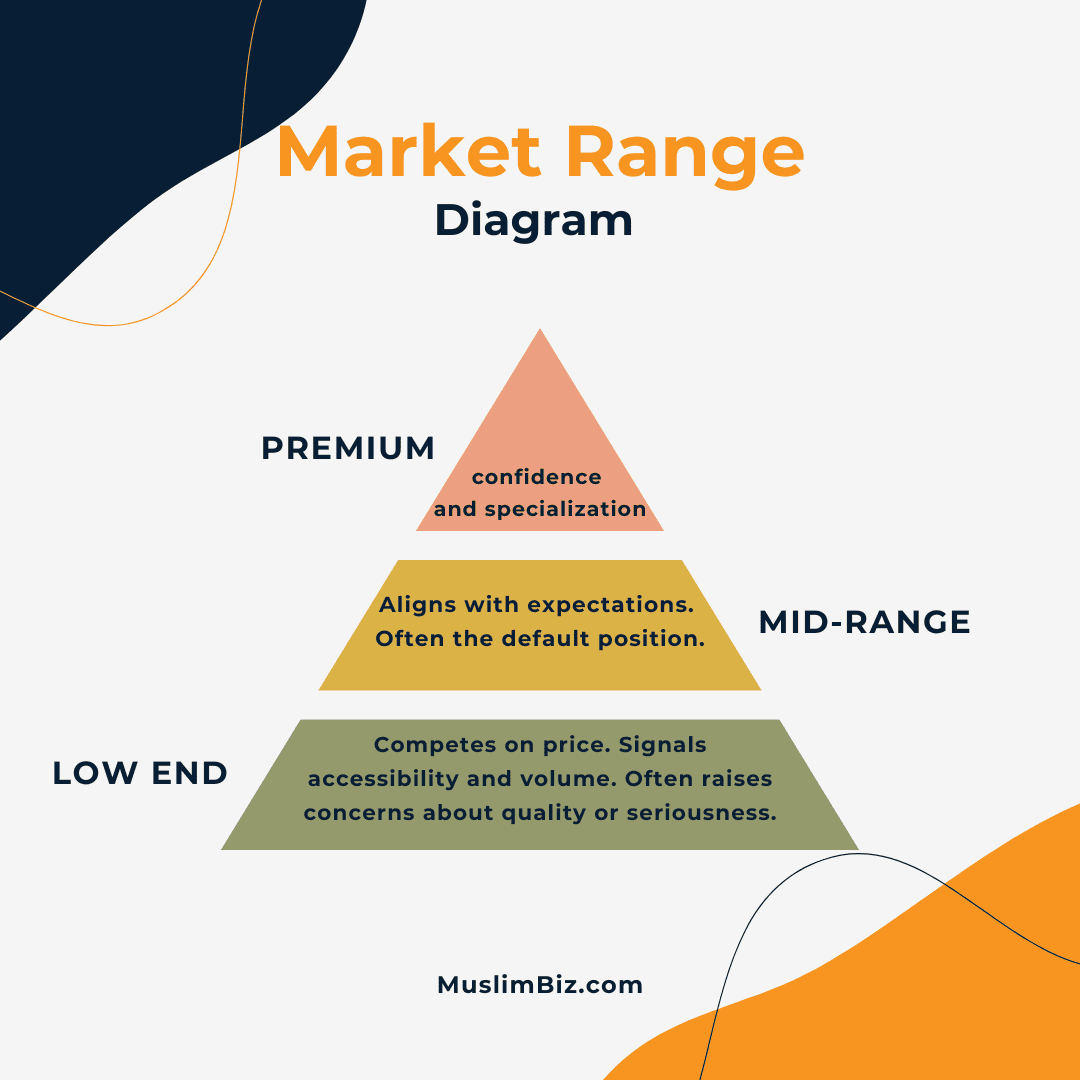

Think of pricing as a spectrum, not a single number.

Low end

Competes on price. Signals accessibility and volume. Often raises concerns about quality or seriousness.Mid-range

Competes on clarity and reliability. Aligns with expectations. Often the default position.Premium

Competes on focus, depth, or urgency. Signals confidence and specialization.

Each position attracts a different customer, requires a different operating model, and carries different expectations. The mistake is drifting into a position unintentionally.

Many founders end up pricing low not because it is strategic, but because it feels polite. Politeness is not a business strategy.

Even with value and market awareness, pricing still should not be finalized in theory. It needs exposure to reality.

Early pricing should be treated as a hypothesis, not a conclusion.

You do not “set” a price. You test it.

This can happen through:

Pre-sales

Pilot offers

Limited early access

Direct conversations with potential buyers

The goal is not immediate perfection. The goal is information.

Hypothesis → Test → Signal → Adjust

Hypothesis

What you believe the product is worth based on the problem it solves.Test

Offering it at that price to real people, not surveys or friends.Signal

Acceptance, hesitation, objections, requests for discounts, urgency, silence.Adjust

Refining the price, positioning, or offer based on evidence.

If people hesitate, that is data.

If people push back, that is data.

If people accept quickly, that is also data.

A common mistake is interpreting “too expensive” as rejection. Often it is a signal that value has not been communicated clearly or that the buyer is not the right customer.

Testing pricing requires emotional resilience, but it removes guesswork faster than any spreadsheet ever will.

This leads to a counterintuitive insight many founders resist.

Lower prices do not always increase demand. In many markets, they reduce trust.

When a price feels unusually low, buyers subconsciously question:

Quality

Reliability

Experience

Commitment

This is especially true for services, education, consulting, and solutions tied to important outcomes. A price that feels too cheap can signal that the provider does not fully believe in the value of their own work.

Strategic pricing does more than generate revenue. It filters customers.

Higher prices often attract buyers who are:

More committed

More responsive

More aligned with the intended outcome

This is not about charging as much as possible. It is about charging in a way that reflects seriousness and intention.

From an Islamic perspective, sustainability matters. Excellence in work, ihsan, cannot be maintained when a business is structurally underpriced and the founder is exhausted.

Underpricing that leads to burnout is not humility. It is misalignment.

Which brings pricing into a broader frame.

6. Pricing as a Strategic Signal

6. Pricing as a Strategic Signal

Your price communicates who you are before you say a word.

It signals:

Positioning

Maturity

Confidence

Long-term ambition

Pricing influences who says yes, who walks away, and who expects exceptions. It shapes your business model more than most founders realize.

A price aligned with your strategy creates coherence between:

The customer you want

The problem you solve

The way you grow

A price chosen out of fear creates tension that shows up everywhere else. In marketing. In delivery. In boundaries.

This is why pricing should never be treated as a standalone decision. It is part of the architecture of the business.

So where should founders start when everything feels uncertain?

Subscribe to Muslim Founder's Newsletter

The only newsletter you need to start & grow your Muslim business, Insha'Allah.

100% Free. No Spam Guaranteed.

7. The One Question That Should Guide Every Pricing Decision

Before spreadsheets. Before competitors. Before margins. Ask this:

What problem am I solving, and how painful is it?

Pain creates urgency. Urgency creates willingness to pay.

If the problem costs the customer time, money, stress, or risk every day it remains unsolved, pricing power increases naturally. If the problem is optional or cosmetic, pricing pressure increases.

Founders often ask, “What should I charge?”

A better question is, “What does it cost the customer to do nothing?”

When pricing starts here, everything else becomes clearer. Value articulation improves. Market positioning sharpens. Testing becomes easier.

From Guessing to Confident Pricing

Subscribe to Muslim Founder's Newsletter

The only newsletter you need to start & grow your Muslim business, Insha'Allah.

100% Free. No Spam Guaranteed.